How much can i borrow with 20k deposit

Then add and verify your Funding primary account on or before 9302022 and Kabbage will deposit 200 into it. 1 year 5 years.

How Much Can You Borrow For A Home Loan

Extra eligibility requirements for unsecured business overdraft.

. 241 comments 48 shares Halifax slashes the minimum deposit to. This offer is provided by Kabbage from American. 20k Note that this information is drawn from publically.

Equipment or stock as an alternative to providing a deposit to the seller Secured by deposit or other acceptable security. For existing customers applying for unsecured business overdraft your business will need to. You can make payments out over as long as five years.

The loan term is set at 30 years. Can I get an Auto Loan without a down payment. Charged at the beginning of the month.

The value of your property is assumed to be the same as the amount youd like to borrow plus deposit. We want to transfer him 15000 for a house deposit so he is not needlessly paying money to a. We can lend up to a maximum of two months revenue.

These estimates are indicative only and actual costs and the amount you could borrow may vary based on a number of factors including loan purpose. Your LVR is calculated by dividing the amount youd like to borrow by the value of the property as a percentage. How to Invest 50K.

22 Side Gigs That Can Make You Richer Than a Full-Time Job. 2 or more years. Reverse Mortgage Line of Credit.

This currently corresponds to. The Pension Loan Scheme allows Australian retirees including self funded retirees to borrow up to 150 - or 15 times - the maximum Age Pension paid fortnightly. You can also immediately start overpaying any debts that you may have.

Under IRS rules you can borrow up to 50 of the value of the plan up to 50000. That will get you the money you need to pay the tax debt without creating a new tax liability. The loan term is set at 30 years.

You can apply to top this up following a few successful repayments as many of our customers do. So if you generate 50000 in a typical month you could borrow up to 100000 initially. Fixed Deposit Auto Loan.

How to Invest 100K. Save as much on the salary increase as you can just direct deposit to savings max out 401k and IRA contributions etc. How to Invest 20K.

You must have at least 20k of your offset home loan assigned to a variable interest rate. If youre saving up to get hitched or perhaps your parents have given you some money make sure you maximise the interest. In 2021 the reverse mortgage line of credit continues to be the most popular option for homeowners when choosing how to access their funds.

A two-month loan is equivalent to twice the average of the members last twelve 12 MSCs posted. But look into taking a 401k loan instead. 6 months- 1 year.

The bank has halved the minimum deposit from 10 to 5 meaning borrowers could buy an average-priced home with a deposit of 14500. The actual amount you can borrow can only be determined once you submit a full application to us and we assess your application using our credit criteria applicable at that time. Do this from the outset dont let your self get used to making that kind of money and youll be much better off.

That deadline has also now been extended to the end of the year. Hi Lawrence Not unless the IRS puts a levy on the plan. Elite suggested I borrow the money which I regard as dangerous.

Calculations are based on a variable rate except for the initial fixed rate period if one is. For business loans you could qualify to borrow up to 500000. Your 20k bill.

24 a formal plan to forgive up to 20K in federal student loans affecting millions of borrowers as they awaited a student loan moratorium set to end on Aug. The Biden administration announced on Aug. You can send us an email with you contact information as we provide all the services that you may require and will need to make your idea become tangible.

A one-month loan is equivalent to the average of members last twelve 12 monthly salary credits MSCs or the amount applied for whichever is lower. For the SSS loanable amount under the salary loan offer here is the explanation of the social insurance institution. Borrowers repay personal loans with interest over a fixed period of time and can be used to finance an expensive purchase fund a home improvement project or consolidate debtWhenever we think about loans its almost automatic that we associate it with borrowing.

Allowing you to borrow against a set amount as needed and only requiring interest. See how much you can borrow and with which lender instantly. How much would you like to borrow.

Eligibility credit criteria and type of security determine how much you can borrow. According to an article by AARP borrowers recognized this choice at about 66 of the time when obtaining a reverse mortgage as being the right choice for them. Min Average Balance of AED 20K.

Other fees may apply. Aside from the Social Security System SSS and the Government Service Insurance System GSIS another government agency that the public can turn-to for loans is the Pag-IBIG Fund. With Fleximize you can apply to borrow between 5000 and 500000 depending on your monthly revenue.

Refinance or a home equity loan your best option is to get a free quote. The maximum income available - combined Age Pension and PLS income stream to 150 of the Age Pension rate per annum. Turn your car into a return-yielding asset.

The personal savings allowance PSA means every basic 20 rate taxpayer can earn 1000 interest without paying tax on it or 500 for higher-rate taxpayers. How to Invest 200K. PAG-IBIG SALARY LOAN Here is a guide on how much you can borrow under the multi-purpose loan offer of Pag-IBIG Fund based on members contribution.

The value of your property is assumed to be the same as the amount youd like to borrow plus deposit. Understanding the value of the home is important if you ever want to sell refinance or borrow against your homes value. Work out how much you can save for a home loan deposit based on your weekly fortnightly or monthly contributions.

A personal loan is a type of loan that you borrow from a bank credit union or any other financial institution. You can see what your rate will be and how much you can get. We can be reach at Phone.

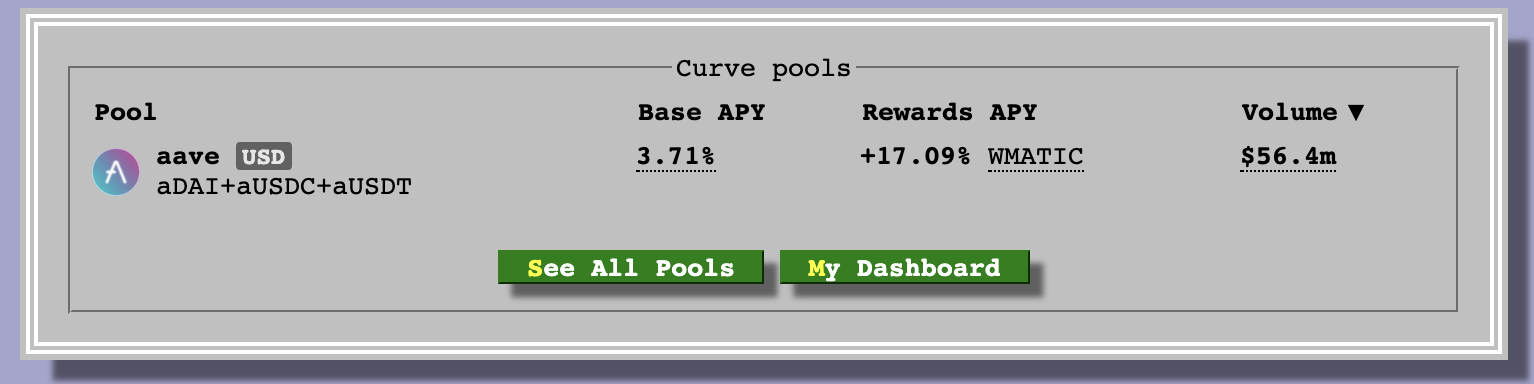

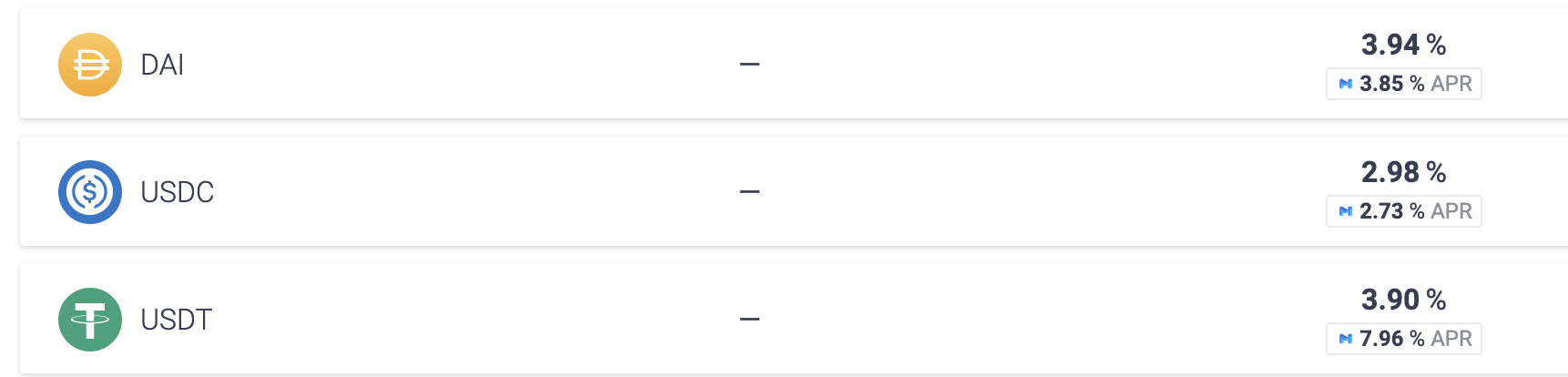

Automate A Defi Yield Farming Strategy On Polygon And Aave Forcedao Funded Issue Detail Gitcoin Gitcoin

20k Loans 20 000 Personal Loans With Good Bad Or Fair Credit

![]()

20k Loans 20 000 Personal Loans With Good Bad Or Fair Credit

How To Get A 20 000 Personal Loan Fast Credible

Need 20 000 Personal Loan Urgently Moneytap

First Time Buyers Cavendish Gloucester

What Is A Bridging Loan Money Co Uk

Borrowing Power Calculator How Much Can I Borrow Westpac

![]()

11 Steps How To Borrow Money From A Friend Or Family Member Student Loan Hero

Wuj Trc0hdmq0m

Need 20 000 Personal Loan Urgently Moneytap

How To Get A 20 000 Personal Loan Fast Credible

6 Indicators For Trading Bsc Defi Tokens Boost Your Trading Profit By Dapp Com

![]()

Who Do So Many Here Suggest Using A Heloc As Your Emergency Fund Wouldn T Borrowing Money During An Emergency Be The Last Thing You Would Want To Do R Personalfinancecanada

How To Make 20k A Month

Automate A Defi Yield Farming Strategy On Polygon And Aave Forcedao Funded Issue Detail Gitcoin Gitcoin

First Time Buyers Cavendish Gloucester