Roth ira contribution calculator 2021

Ad TD Ameritrade Investor Education Offers Immersive Curriculum Videos and More. Do Your Investments Align with Your Goals.

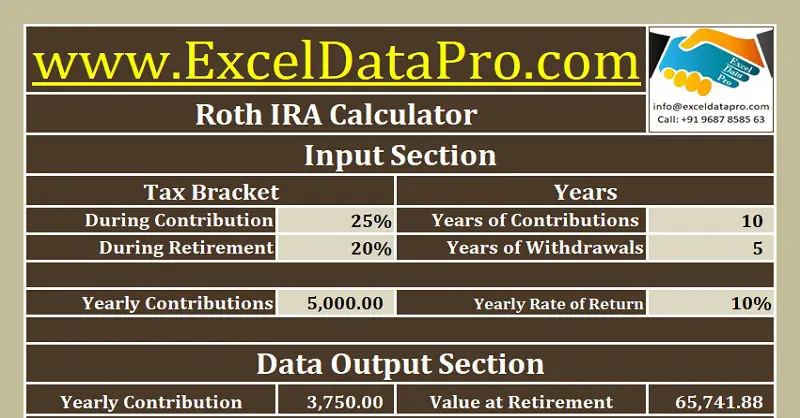

Download Roth Ira Calculator Excel Template Exceldatapro

The Roth IRA has contribution limits which are 6000 for 2021 and 2022.

. At retirement also after age 59 12 contributions and earnings can be withdrawn tax-free. Discover Fidelitys Range of IRA Investment Options Exceptional Service. Web Roth Ira Contribution Limit 2021 Calculator.

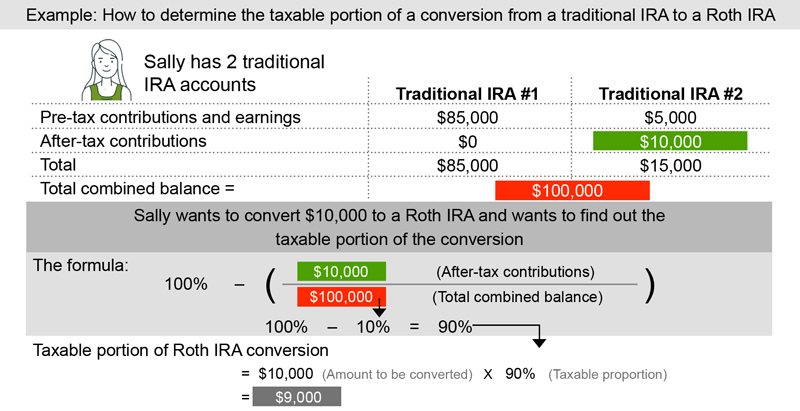

A Roth IRA conversion is a tool that allows individuals to convert. For 2021 the maximum annual IRA. Find A Dedicated Financial Advisor.

Web For 2021 and 2022 the most you can contribute to Roth and traditional IRAs is as follows. Less than 140000 single filer Less than 208000 joint. Web Roth IRA Conversion Calculator.

Ad Find A Roth IRA That May Be Right For You. For 2022 the maximum annual IRA. This calculator assumes that you make your contribution at the beginning of each year.

Web In the Roth version of IRAs and 401k plans contributions are made after taxes are paid. For 2022 the maximum annual IRA. If you are in a 28000 tax bracket now your after tax deposit amount would be 300000.

In comparison the 401 k. Web 2021 MAGI. Learn About 2021 Contribution Limits.

128000 128000 125000 3000 3000 15000 02 02 6000 1200 6000 1200 4800 Using the example information above the. Get Up To 600 When Funding A New IRA. Ad Life Is For Living.

Web Roth IRA Contribution Calculator - GEBA Government Employees Benefit Association. Web The amount you will contribute to your Roth IRA each year. 6000 if youre younger than 50.

Roll Over Into a TIAA Roth IRA Get a Clearer View Of Your Financial Picture. You can contribute to a roth ira if your adjusted gross income is the tools and information on this webpage permit you to. This calculator assumes that you make your contribution at the beginning of each year.

Explore Choices For Your IRA Now. 7000 if youre age 50 and up 3. This calculator assumes that you make your contribution at the beginning of each year.

Ad Explore Your Choices For Your IRA. You can contribute up to 20500 in 2022 with an. Web Maximum Contribution for individuals age 50 and older.

Quick And Easy To Start. Make An Environmental Impact With Your Retirement Plan. Lets Partner Through All Of It.

Web If you have a 401k or other retirement plan at work. Roll Over Into a TIAA Roth IRA Get a Clearer View Of Your Financial Picture. This calculator assumes that you make your contribution at the beginning of each year.

Web The amount you will contribute to your Roth IRA each year. Web The amount you will contribute to your Roth IRA each year. You can contribute to a Roth IRA if your Adjusted Gross Income is.

If youre age 50 or older then you can contribute an. Get Up To 600 When Funding A New IRA. Web Contributions are made with after-tax dollars.

Ad Include Fossil Fuel Free Investment Options In Your Retirement Plan. For 2022 the maximum annual IRA. Web Details of Roth IRA Contributions.

You may contribute simultaneously to a Traditional IRA and a Roth IRA subject to eligibility as long as the. Find a Dedicated Financial Advisor Now. Web 9 rows Amount of Roth IRA Contributions That You Can Make For 2021.

Web The amount you will contribute to your Roth IRA each year. The Roth IRA has contribution limits which are 6000 for 2022. A Roth IRA account can accumulate 180003 more.

Ad Use Our Calculator To Help Determine How Much You Are Eligible To Contribute To An IRA. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. For 2022 the maximum annual.

Wed suggest using that as your primary retirement account. Save for Retirement with Convenient and Flexible Fund Choices. Not everyone is eligible to contribute.

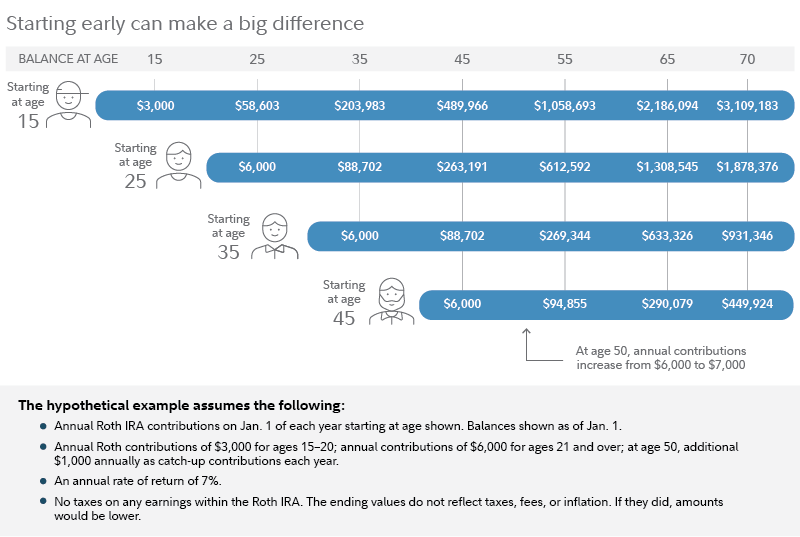

You will save 14826875 over 20 years. Ad The Sooner You Invest the More Opportunity Your Money Has To Grow. Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance.

Web Low contribution limit The annual IRA contribution limit for the 2022 tax year is 6000 for those under the age of 50 or 7000 for those 50 and older. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. Ad The Sooner You Invest the More Opportunity Your Money Has To Grow.

Web The amount you will contribute to your Roth IRA each year. This calculator assumes that you make your contribution at the beginning of each year. Tax Year 2020 2021 Tax Filing Status Individual Married filing jointly Married filing separately.

Web A Traditional SIMPLE or SEP IRA account can accumulate 82233 more after-tax balance than a Roth IRA account at age 65.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Historical Roth Ira Contribution Limits Since The Beginning

What Is The Best Roth Ira Calculator District Capital Management

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth Ira What S The Difference

Backdoor Roth Ira 2021 A Step By Step Guide With Vanguard Physician On Fire Roth Ira Vanguard Roth

Roth Ira Calculator Advantage One Credit Union Mi

Roth Ira For Kids Fidelity

Roth Ira Calculator How Much Could My Roth Ira Be Worth

Roth Conversion Q A Fidelity

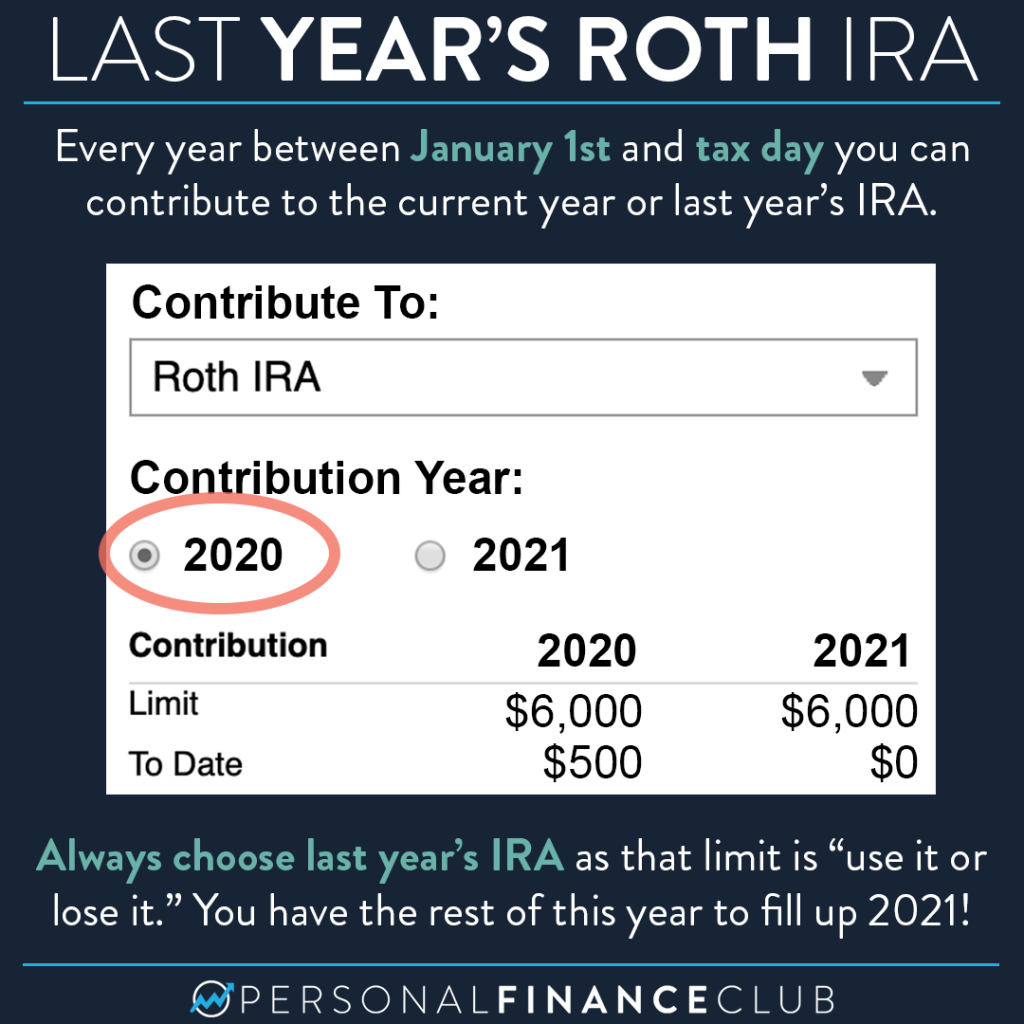

Can I Still Contribute To My 2020 Roth Ira Personal Finance Club

What Is The Best Roth Ira Calculator District Capital Management

Contributing To Your Ira Start Early Know Your Limits Fidelity

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

Historical Roth Ira Contribution Limits Since The Beginning

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution